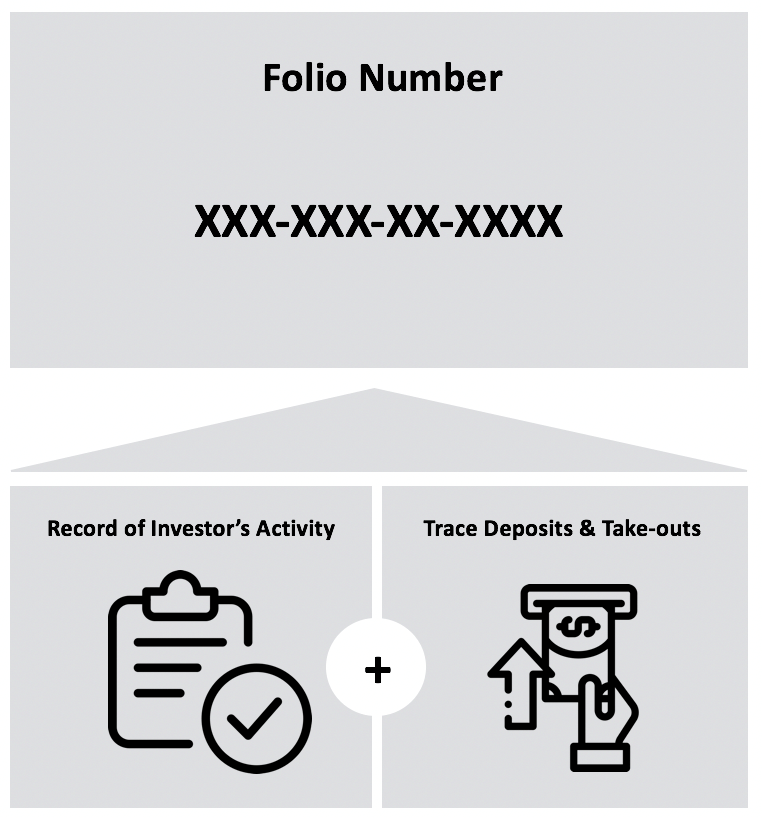

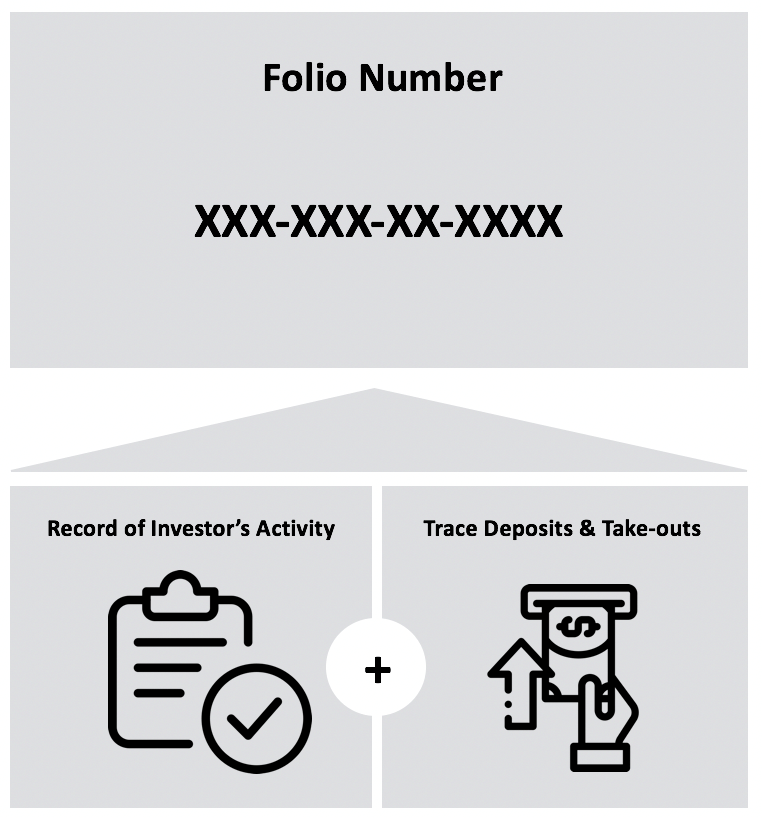

A folio number is an identification code for one’s own account in a mutual fund. Similar to a bank account number , a folio number helps identify the investors within a fund. It also records the amount of money each investor has allocated within the fund, along with the contact and transaction details.

When individuals invest in mutual funds, the returns they receive and the fee structure are recorded in their folio number account. Although the broker often facilitates the investments and communicates the results to the investor. Often, such individuals may request a folio number history just to analyze the accuracy of the data. Furthermore, a folio number account can be used to make multiple purchases of the same mutual fund.

An investor can request multiple folio numbers that directly link to a single mutual fund. If they wish to consolidate all their folio codes into one, they have the option to do that as well.

A mutual fund is an investment vehicle that holds a basket of equities, bonds, and other securities. They are diversified investments that are managed by portfolio managers at a low-cost fee. They tend to be built based on investor’s preferences, which is driven by risk tolerance.

For example, an investor who wishes to have a portfolio that is 60/40 equities and debt would have a significantly riskier mutual fund relative to an individual who would prefer 30/70 equity and debt allocation.

When a mutual fund is purchased from an institutional investor, a management fee is often integrated to pay as a small price of managing the portfolio.

Dividends received from current investments are reinvested back into the fund to allow for growth.

As mutual funds offer a wide range of investments within a single vehicle, it ultimately provides diversification benefits, reducing unsystematic risk.

Despite the diversification and management aspects of mutual funds, they tend to be more expensive relative to other investments. Therefore, with higher fees, it tends to lower the overall investment return on the portfolio.

The investment manager exercises significant authority over the fund’s investments. Meaning, if they wish to conduct any sort of unnecessary trading, selling investments under a realized loss, or any other behavior that would negatively affect the investors’ gains, they would be enabled to do so, as long as it is within the fund’s investment strategy.

Checking the mutual fund statement used to be the only way to access the folio number. Thus, when these statements were misplaced, many investors had undergone trouble to receive a new one. However, now, there are a variety of methods to retrieve one’s folio number including:

The advantages of a folio number are the following:

CFI offers the Capital Markets & Securities Analyst (CMSA)® certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following resources will be helpful: