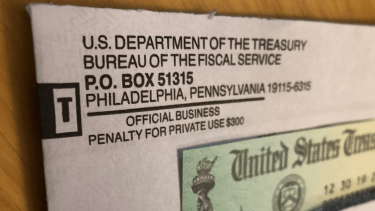

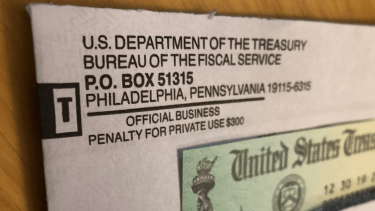

IRS scams take on all shapes and sizes. The tax collection agency says a relatively new one works like this: hackers break into computer systems belonging to tax preparers and accountants. They steal customer data, and file bogus tax returns. Those taxpayers will receive a real, legitimate refund check from the IRS. Then, soon after, the crooks call the check recipient, posing as the IRS, and claiming there's been an error. They demand the taxpayer wire them the refund. By the time the taxpayer learns what's happened, their money is long gone.

The IRS first alerted taxpayers to this scheme in 2018, and it says the scam takes on a variety of forms. For example, the scammers might pose as a debt collection agent working for the IRS to demand payment, or they might claim they are law enforcement agents with an arrest warrant.

The crimes don't always involve printed checks, either. Some scammers will follow a tax refund via direct deposit to the victim's bank account, then call them and say the deposit was made in error. They will demand the taxpayer return the funds to a specific bank account, or even ask for access to the victim's bank account, which can expose the victim to even more financial losses.